(… even though I, myself, am an SR&ED Consultant.) This morning I received an invitation via LinkedIn that inspired me to write this post. It’s a topic that’s been irking me for a while now. You may be thinking to yourself, “don’t you run a firm that specializes in SR&ED”? Yes, I do.

What are SR&ED consultants?

First, let me explain my understanding of the term “SR&ED Consultant”. It is composed of two parts: SR&ED and consultant. The SR&ED portion is straightforward – it refers to the Scientific Research and Experimental Development tax credit program, which is quite generous if you are a business that qualifies. (Read about it at SR&ED Education and Resources).

The challenge is defining the term consultant. A generally accepted definition is that a consultant is…

an expert or a professional in a specific field and has a wide knowledge of the subject matter 1

Following this logic, someone who is an “expert” in SR&ED will have a “wide knowledge of the subject matter”. I personally ascribe to the theory that 10,000 hours makes an expert, as per Gladwell’s theory in his book Outliers (although others such as Seth Godin argue that 5,000 hours is sufficient). Further, it’s not enough to have put in the time – one needs to demonstrate competence. My definition of competence is when you have submitted over 100 SR&ED claims and had them “Accepted As Filed” (ie. no changes/challenges/reductions).

Naturally, while becoming an expert, one will develop the “wide knowledge of the subject matter”. Some of the relevant areas that an SR&ED consultant will become intimately familiar with are as follows:

- Relevant sections of the Income Tax Act

- All technical and financial policy documents, in addition to the SR&ED Glossary and Claim Review Manual.

- The processes and procedures in their local tax office and all the local Research and Technology Advisors (RTAs)

- How to compile research related to the technology baseline (“knowledge base”), review supporting documentation, and ask questions that elicit the correct information.

- Unwritten, undocumented “red flag” words/terms the CRA uses to screen for “risky” applications.

- Tax Court of Canada rulings since the inception of the program (in particular, Northwest Hydraulics) and other cases that highlighted key concepts, such as SR&ED and business context or the importance of answering the providing sufficient information.

One can learn all of the above points without hands-on experience (ie. understand the theories); however, writing/preparing/submitting SR&ED claims provides an additional level of insight into the program (ie. experiential learning).

As you can discern, a background in technology, accounting, or law is useful in relation to SR&ED; in fact, some individuals will argue that it is critical that you have a technology background. This is very helpful, but not essential – unless you are a technology consultant working on the R&D project they will be submitting. The role of the SR&ED consultant is to understand the program and help claimants – ie, the true experts -understand the program and communicate how their work does or does not meet these requirements. The CRA makes it clear that identification of SR&ED is an internal process: “identifying SR&ED requires technical personnel who performed, are familiar with, or are responsible for the work.” A true SR&ED consultant provides guidance on the SR&ED program and how to apply; be wary of any consultant who claims that technical knowledge is more important than an understanding of the policies or clearly communicating the work performed to the CRA.

The question is, how can the average business owner identify and avoid consultants that do not meet the criteria of “consulting expert”?

Sample So-Called SR&ED Consultants – Key Features

First, acknowledge that they exist. I had a feeling there were disreputable consultants long before the Globe and Mail stirred up a controversy and tarred all preparers with the same brush. At networking events, I would often refrain from describing my profession. I’ve spent years building my business, why not promote it? It’s simple – people who were pleasant only moments ago would physically recoil when I would mention my specialization. Perhaps you’re familiar with this defensive posture?

SR&ED? No thanks!

The inevitable conclusion from many of the knee-jerk reactions (“we’re ok” / “I don’t need SR&ED” / “oh….” *awkward silence, looking around*) is that there are people out there who don’t necessarily engage in ethical or even best business practices. Until today, I’ve managed to avoid most of them.

Here are some examples to help you pick out firms you probably shouldn’t work with…

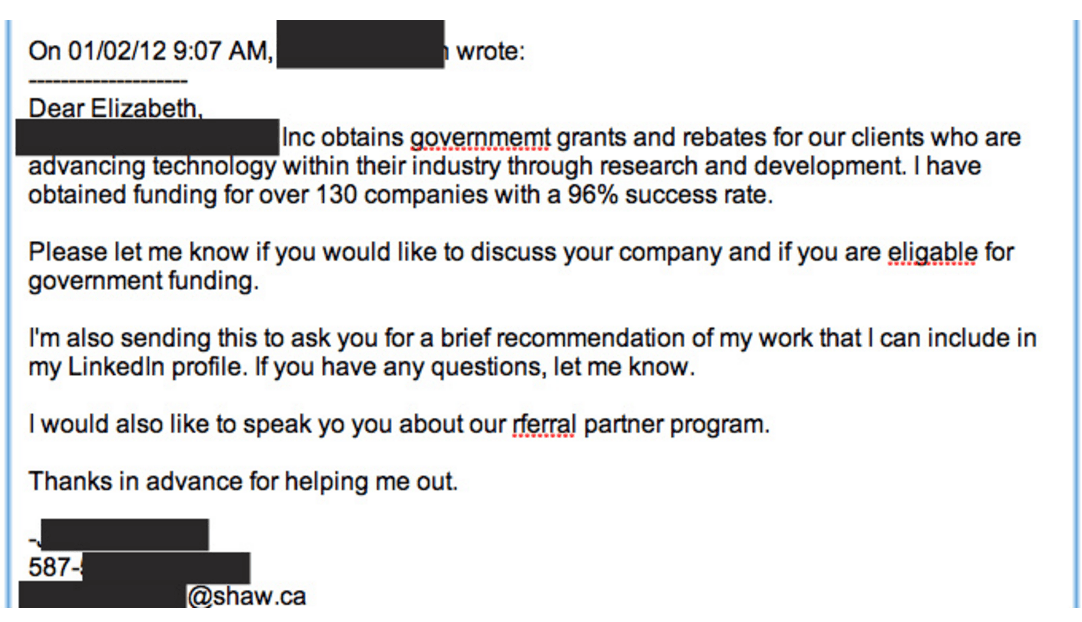

SR&ED Sales Fail

First, why would you send this to another SR&ED consultant? Did you not read my profile? Yes, I have a technology company as well. Guess what? I’m probably going to do this in-house.

Second, why are you asking me for a recommendation? I’ve never worked with you. I don’t know you. What I’ve seen so far is that you haven’t proofread your email. That really, really bothers me given the services you claim to provide.

Third, your signature tells me you haven’t taken the time to set up a domain and you may be a one-man show. No disrespect intended towards independent consultants or those work from home – if you can avoid the overhead, go for it. As the first unofficial day back (Jan 2nd), I’m in comfy clothes and I have a dog curled up at my feet while I catch up on emails… but for goodness sakes, set up your corporate email account.

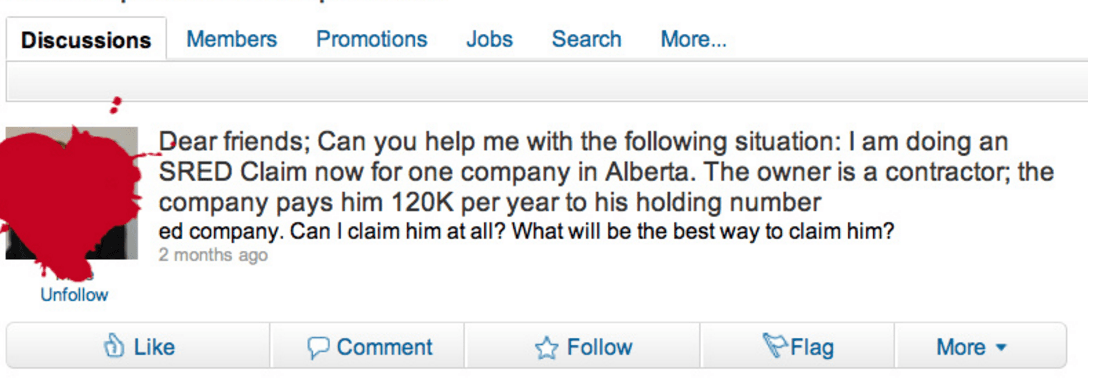

Services Fail

If you’re a good SR&ED consultant, you’ll know why I included this posting. For everyone else, here’s why: a very, very basic rule is that non-arms length contractors are not eligible. If you own part of the company you should be salaried. Why? Because *nothing* is eligible if you’re non-arms-length and skipping out on source deductions. Nada. Zip. Zero. That’s over $62K gone forever.

This is a simple point that he should have known. There are ways that – in special circumstances – this amount could be restructured. They’re high risk and can be costly, but a good consultant could have helped avoid this situation. Avoid the hassle by avoiding this type of consultant and seeking advice early in the development process.

This also illustrates the power of LinkedIn. Skim through the SR&ED groups and you’ll quickly identify the influential individuals. Then go to their profiles to review, compare and contrast. This individual’s profile showed a jack-of-all-trades-master-of-none. Avoid at all costs (lest you wish to lose another 62K).

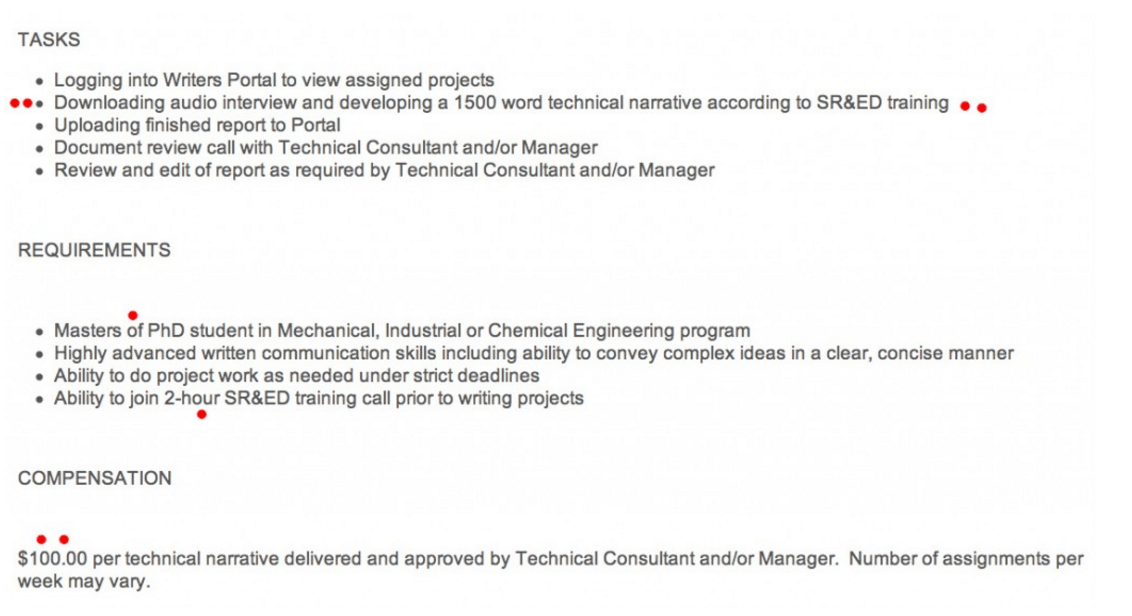

You Pay The Firm A Lot, The Person Who Writes Your Claim Is Paid Less Than Minimum Wage

This is an example of a job posting I’ve seen on several different occasions for one of the SR&ED boutique firms. I’ve pointed out in red a few key points (and spelling mistakes), but the takeaway is this:

If you knew that students were being paid $100 per 14002 words SR&ED technical narrative, would you pay 20-30% of your entire refund to the SR&ED firm?

The technical narrative is the most important part of the SR&ED claim. It’s the first thing the CRA reviews. Theoretically, it’s reviewed by a senior individual, but take a look at the training that was provided. What are you paying for, exactly?

Attention to Detail

Tiny mistakes may seem insignificant, but they can cost you both money and time. Leaving a box unchecked can lead to serious delays or miscalculations of your refund. One error, recently made by a Chartered Accountant (more likely, their assistant) has meant a delay to the taxpayer by almost two months. Their file was “Accepted as Filed” but the money is sitting in limbo awaiting disbursement. In the land of startups, two months is an eternity.

Summary

These are only a few examples. I have no doubt there are more, based on the negative conceptions many people have of this group of professionals. Truthfully, I can’t blame them. It seems as though any technology company is considered fair game and is aggressively pursued by SR&ED sales teams. Unfortunately, the pushiest are not always the best. Below are a few ways to identify & protect your company from “cottage-country”3 SR&ED consultants.

How to Protect Yourself

- Ask about experience. Remember those six points above? Start with those. Move on to asking about the latest ruling in the Tax Court of Canada. If they know SR&ED, they can discuss this in relation to existing practices at the CRA. Read this blog before you meet – so you already know the answers.

- Question the “success” statistics they quote you. Is it based on the number of files “Accepted As Filed” (quick refund) or total amount refunded? How long does it usually take them?

- Attention to detail is everything. Are there spelling mistakes? How do they present themselves? Sure, we’re all human and make mistakes. How do they correct errors? This is the business equivalent of a job interview. Mistakes due to inattention can cost you thousands in SR&ED tax credits. Save yourself the hassle and be ruthless in your selection process.

- Beware of bait and switch. Find out who will actually be working on your file. In a larger organization, it will likely be a junior individual that is overseen by a manager. There’s nothing wrong with this approach; however, ensure that you (a) want this and (b) know the level of involvement of the senior individual.

- Review recommendations. Can they provide reference clients? What are people saying about them publicly? Some people are modest geniuses – most are not. Call and ask around about a particular individual or group. If you have concerns, discuss them. We’ve all fired clients or service providers, find out both sides. Trust your instincts.

- Follow your gut. Recent research has indicated that we have a “second brain”.4 Trust yourself. If it doesn’t feel right, move on.

Ultimately, it comes down to this: take your time and do your due diligence. This is a significant financial decision and it deserves your attention. Sometimes it’s worth it to pay more, but a big price tag isn’t necessarily an indication of quality. Most importantly, if your gut says this isn’t right – listen! There are more than a few great, ethical SR&ED experts in Canada. You’ll find the right one for you soon enough.

Update: It’s been brought to my attention that I’m not the first to write on this topic. Here is another great article on identifying ethical vs. unethical SR&ED preparers.

- Pieter P. Tordoir (1995). The professional knowledge economy: the management and integration services in business organizations. p.140 ↩

- 350+350+700=1400, not 1500. ↩

- McKenna, Barry. Flawed R&D Scheme Costs Taxpayers Billions. In The Globe and Mail. Retrieved January 4, 2012, from http://m.theglobeandmail.com/report-on-business/flawed-rd-scheme-costs-taxpayers-billions/article1939418/?service=mobile ↩

- Our Second Brain: The Stomach. In Psychology Today. Retrieved January 4, 2012, from http://www.psychologytoday.com/articles/199905/our-second-brain-the-stomach ↩

22 Comments

Brennan · January 3, 2012 at 4:32 am

It’s been a while since I’ve read something so impassioned, but I love it! ^_^ I’m sorry to hear there are a lot of scammers in your industry….I think it’s true of a lot of service-based businesses….

Elizabeth Lance · January 3, 2012 at 3:18 pm

Hi Brennan,

I suppose this is nothing compared to the Ocean Marketing “PR” debacle! You’re right, service-based industries are easy to start and thus more prone to sketchy business practices.

Thanks for your note, it’s appreciated! 🙂

Liz

Pierre Savignac, Emergex · January 6, 2012 at 11:44 am

Hi Elizabeth. Your articles are always interesting, but also very well articulated and written, even funny at times. Keep up the good work of demonstrating the professional side of our SR&ED industry through your actions and communications.

I remember 10 years ago when I had to convince entrepreneurs to try the SR&ED program, as they did not believe money was handed out for salaries they paid anyway. That was what I call the “evangelization” era.

Today, I consider that our industry is now saturated, with many more firms and consultants running after the same limited pool of prospective clients. I too have seen a negative perception about SR&ED consultants during our networking and marketing efforts.

It is our collective responsability to prove our value and integrity to the rest of the world through our actions, including your great articles.

And thank you for the good words about our offices, that you seem to appreciate!

Elizabeth · January 23, 2012 at 5:09 pm

Hi Pierre,

Thank you for your note! It’s interesting to hear about your experiences having been in this area for so many years. And yes, I loved seeing your office – it’s the level of professionalism that all groups should aspire to.

I hope to read more of your writing on this topic – the historical aspects I find particularly interesting. After all, they may help us see what is coming!

Warm Regards,

Elizabeth

J. N. · March 5, 2013 at 3:56 am

Having dealt with a number of SR&ED consultant firms, I have to say that our company did fall prey to some of the less ethical consultants out there. I know we are mostly to blame for not making an informed decision. I mostly blame on how attractive initially the a contingency payment plan is.

The contingency model of payment does seem attractive to newbies mostly because they feel that it presents no financial risk to them. This feeling of course is because they do not truly feel that the SR&Ed returns is actually their money being handed back to them. In addition it does present a “deal with it later” financial cost.

My quarrel however, lies with some of the consultant firms that claim to be experts when they are not even remotely so. The firm we dealt with consisted of two members, an IT manager of sorts and a retired programmer. Now if all the claims they were undertaking were software related then by all means they could perhaps be labeled as experts, however they were processing industrial and manufacturing claims! Being an engineer, what bothered me most is they claimed to be engineers when that was not the case…

They charge 20% but if you are to follow the path of your actual process in their hands you will find it ending up in the hands of some student subcontracted for the write up for a mere few hundred dollars. SR&ED what was once a program to encourage innovation and scientific research is now filled with used car salesmen!

PS: In my opinion it will do you good to avoid consultant firms such as [NAME REMOVED AT REQUEST OF SRED FIRM 16/04/13], perhaps they have improved but in the end you should do your homework.

Elizabeth · March 7, 2013 at 1:26 am

Hi J,

Thanks for taking the time to write such a thoughtful comment. I am sure others will benefit from your experience.

Regarding your points:

1) Yes, contingency fees are very appealing to people new to the program. What most don’t realize is that there is a very real risk they are ignoring – being red-flagged by the CRA. Once you have a file denied in part or in full the CRA will question further submission. Deferring payment also means costs are also higher (20%).

2) Abuse of the term “expert” is true of any field, but it’s particularly painful in this space as the financial stakes can be quite high. One SR&ED veteran in my network (19 years as a CRA SR&ED Research & Technology Advisor, 8 years private-sector consulting) refuses to use the term. Also true of using the term “engineer” in this case…

3) You’re one of the few people that point out there are sub-specializations within the SR&ED space – most believe it is “one size fits all”. It’s not. There are groups that focus on medical research, others in software, and others still in manufacturing! The list goes on. While the policies are the same, the application at the administrative level remains very different.

4) The fact narratives are often subcontracted is not widely discussed. With many of the larger organizations, they will subcontact to professionals in their space. In the smaller ones, they will aim to cut costs and hire students. It’s not fair to the client to have a bait-and-switch approach, nor to the subcontractor who is often paid a fraction of what is charged to the client. In some cases, it’s a markup of over 500%! (Ex. $100 per technical narrative for a 50K refund… most are larger refunds. Try searching “$100 SR&ED Technical Narrative” – I wish I was joking…)

5) Homework is always key. There are some great groups out there – there are many professionals in my network I would highly recommend on any given day. Use LinkedIn, search for references, and ask tough questions. After all, if you knew you were going to pay $20K or upwards of $140,000 to a company that could potentially ruin your reputation with the CRA – wouldn’t you want references? I would!

Thanks again!

Elizabeth

James Normandi · March 12, 2013 at 12:58 am

Hey Liz,

Thanks for elaborating on my comment 🙂

I think it would be cool if there was some sort of accreditation handed out by the government that set the standards for SR&ED consulting. Although there are seminars available organized by the government, I have to say they are not sufficient for a business owner to walk out of there with enough confidence to tackle a SR&ED write up on his/her own for the first time.

Upon reading one of your initial posts, you labeled one of the consulting firms as a “Boutique Firm” and that term really stuck with me because I think you nailed that head on. A number of firms out there are resorting to image to portray success and lure in the clients. I even distinctly remember at one point chit chatting with one of the SR&ED consultants a while back and having him say “In the end we are all salesmen!”….

James N.

Elizabeth · March 12, 2013 at 3:16 pm

Hi James,

I love that you took the time to reply to both the post and my comment. Thank you!

I would agree that accreditation would be nice, but think it should be handled by an existing accreditation body. Accountants (CA, CGA, and CMA) all have their own governing bodies and ethics groups, as do professional engineers. We’re all (theoretically) mature enough to do this ourselves. That said, there have been attempts to start this process but collaboration in this space is difficult.

Yes, the seminars by the government are nice, but they’re more of a pat on the back – they rarely contain enough information for someone to confidently tackle a submission on their own. So much goes back to “it depends”!

In life, we all have to sell ourselves – be it in a job interview, performance review, or marketing report – but whether we do so honestly and ethically is the real question. My angle has always been “teach a man to fish” (pun intended!) – it’s always better if the company has a sound understanding of the program. It’s your company and this could be the single largest cheque sent to you in any given year. I would want to understand the process! Perhaps I’m odd in that sense!

Elizabeth

Heather · November 7, 2013 at 10:24 pm

“Why I hate so-called “SR&ED Experts” | Identifying weak SR&ED Consultants” definitely causes me personally ponder a little bit extra.

I actually adored each and every single element of this blog post.

Regards -Winfred

Tim · May 9, 2014 at 8:31 pm

This was an excellent piece.

I must admit, it’s been a while since I’ve thought to come read through either Sreducation or your blog, but it certainly gave me some things to consider. I’ve worked in the industry for just over 2 years and wouldn’t consider myself an “expert” at all. Frankly, I despise the word as, to me, it implies a level of arrogance in yourself. A personal observation, but nonetheless one that I have had confirmed on more than a few occasions.

At the very least, it served as a reminder that continually reading and reviewing is key. For me, I think that is why I will never consider myself an “expert.” I always feel like I am learning and in that regard, one can’t truly be an “expert” (in my view) if you’re still learning. Highly knowledgable and experienced; certainly, but not an expert in my view of the term.

You mentioned the “second brain” and I noted that you quoted Gladwell early on in your post. I assume you’ve read Blink then? The entire concept of the “second brain” makes me think of Gladwell’s theory in Blink.

Elizabeth · June 3, 2014 at 1:50 pm

Hi Alex,

There are many different groups available to you, so it depends on what you’re looking for. Each has a particular strength and weakness. There are consulting companies that subspecialize (for example, I focus on CBRNe and Defence Software subcontractors that also apply for OIDMTC) while others are generalists. The Big 4 have national teams as do some boutiques, but it’s harder to get their attention if you’re a startup. Individual shops have better pricing but you’ll need to know what you want.

Why not take a look at SRED Education and Resources for some ideas? You can reach me via the “Contact Us” form for more details. Before proceeding, take a moment to think about what would be important to you (the same way you would when finding an accountant – experience in your space, proximity, etc).

Hope this helps!

Best,

Elizabeth

Michael · December 3, 2014 at 6:39 am

Hi Elizabeth,

Great blog. I am actually considering entering the field of SR&ED Consulting, and have been going through the interview process with a specific firm. I was wondering, if I were to privately ask you about this firm, if you could tell me a bit about whether they are reputable or not?

I know this is perhaps a conflict of interest in some way, but some help would be hugely appreciated.

Regards,

Michael

PhDScience · October 28, 2015 at 2:01 am

Hi,

Interesting, but you seem to forget one of the most important criteria for determining if your consultant is an impostor: its scientific/engineering background. For example, only an experienced software engineer/programmer/architect can determine if a project is SRED eligible. Concrete R&D experience and scientific education (a baccalaureate and preferably a master/phd in your field of expertise) is also required. From my experience, most people who dont fit such criteria are impostors. Elizabeth, do you fit such criteria or you’re just another bullshitter who is trying to get exposure?

Elizabeth · December 16, 2015 at 11:39 pm

Hi PhD Science,

While having a PhD is a notable achievement, it does not guarantee that you will be an expert in anything beyond your area of specialization and it does not guarantee you are an expert in the SR&ED program. As stated in the Eligibility of Work policy, identifying SR&ED “requires technical personnel who performed, are familiar with, or are responsible for the work.” The role of a consultant is, in my opinion, to help claimants understand the program requirements and assist them with correctly communicating their work to the CRA. The true experts – those that conducted the work and are considered “qualified individuals” by the CRA – must be the ones to determine whether or not SR&ED occurred. [This statement is also reflected in multiple Tax Court of Canada rulings, including 6379249 Canada Inc. v The Queen, 2015 TCC 77.]

I believe that having already completed one Masters degree, completing a second MASc in Technology Innovation Management from the Department of Computer and Systems Engineering (with electives in Science, Technology, and Innovation Policy), and having started programming at the age of 16 would mean that I am uniquely qualified to work with software teams in relation to SR&ED. The millions that my clients have received over the last 8 years is not “luck” as a result of “bullshit”. I am an expert in the SR&ED program. My clients are – and will always be – the experts in their technology. My job is to use my knowledge to showcase theirs. Period.

Finally, none of the above matters without the ability to communicate clearly. If the CRA cannot understand you, you will not receive a refund. You may wish to work on this skill, as your post is riddled with spelling and grammatical mistakes. I am available to proofread your next SR&ED submission. 🙂

Alan Serpa · December 4, 2015 at 6:28 am

Hi there are you for hire.

Elizabeth · December 17, 2015 at 12:04 am

Hi Alan,

Absolutely, I can be contacted via http://www.InGenuityGroup.ca – let’s discuss.

Elizabeth

Bruce · March 16, 2017 at 8:51 pm

I was once contacted by an SR&ED consulting firm to write claim documents for them. After reading this, I’m kind of glad I never ended up working for them.

elizabeth · March 16, 2017 at 8:55 pm

Thank you for your comment, Bruce. As with so many service available to businesses, quality and professionalism can vary between service providers. From your (very interesting) website, it appears you’ve found a great writing niche instead. I hope some of the readers of this website will reach out to you.

Lino Iapaolo · May 8, 2017 at 2:55 pm

Elizabeth,

I’ve read your article and it’s obvious that there is no question that there are some shady Consultants out there.

At the same time, there are many reputable SRED consultants and Accounting firms that operate ethically and with the utmost integrity. Like anything in life, it is up to the Consumer to do their diligence when partnering with any type of service provider.

Whether or not you want to handle the claim on your own or find a reputable provider to file a claim on your behalf is up to you.

Just my opinion, Tax Law in Canada is not a DIY initiative and that’s why I prefer to entrust my claim in the hands of a reputable professional.

Last I checked, the fee for services provided is still tax deductible and it allows me to focus on what I know best- my business.

Have a great day!!

elizabeth · October 19, 2017 at 10:26 pm

Hi Lino, thank you for your comment.

I am glad that you see the value of using reputable consultants who have a broad understanding of SR&ED, have taken the time to thoroughly learn the subject matter, and have a stellar track record in preparing many different claims.

However, I did want to caution you about the following comment, “Last I checked, the fee for services provided is still tax deductible and it allows me to focus on what I know best — my business.” I assume you are referring to SR&ED consulting services. This statement is not correct.

The fee for SR&ED services provided by consultants is not tax deductible under the SR&ED program. According to the Canada Revenue Agency’s (CRA) SR&ED Overhead and Other Expenditures Policy, the CRA, first of all, “does not consider the preparation of technical descriptions for SR&ED claims to be support work” eligible for a SR&ED tax credit, and it does not matter if consultants or the business’ employees prepare this. (“Support work” is defined in the SR&ED Glossary as being “work undertaken by or on behalf of the taxpayer with respect to engineering, design, operations research, mathematical analysis, computer programming, data collection, testing or psychological research.”)

The CRA then goes even further by noting that, in relation to preparing both the technical descriptions and the financial accounting work that goes with them, “no ITC can be earned in respect of fees paid for preparing SR&ED claims.” Why not? The CRA has determined that these fees are “incurred for the general administration or management of the business” claiming them, and thus are not directly related to SR&ED.

The CRA is very conclusive about this.

Incidentally, your IP shows you as being from an SR&ED consulting firm. (I have included the screenshot below.) Shouldn’t you know that you cannot deduct consulting services under the SR&ED program? I certainly hope you are not advising your clients they can deduct your fees. We tried to confirm that you were a real individual, but only a funeral director has your name on LinkedIn. Thank you again for writing, so we could share this information with everyone visiting this website.

Tim Hodges · October 23, 2017 at 12:51 am

I’m a little surprised to hear about the student outsourcing, but not completely. Being in IT for 17 years I often heard stories of big companies outsourcing tasks to small work from home shops so as to avoid paying employees benefits or overseas. Even one of my first job interviews I was told to explain why I was better than someone who the insurance company could outsource the work to in India for $4/hour. I was then asked if I set on getting paid minimum wage or if I would work for less. Seeing the recent showdown with Jeff Bazos and Trump over the foreign visas and the battle over where Amazon HQ2 will be located is another one of these showdowns.

CCI Response to CRA Consultation March, 2024 - "SR&ED is a value statement of where we want to go as a country." - SR&ED Education and Resources · March 25, 2024 at 11:50 am

[…] professional firms. Read our managing director’s take on bad SR&ED consultants in her article Why I Hate SR&ED Consultants. We have also written previously about about the variety of firms and billing […]